In the rapidly evolving maritime connectivity landscape, several players are competing for dominance. In this article we’ll compare two of the leading solutions: Inmarsat and Starlink, their advantages, technologies and implementation.

We’ve previously covered the importance of maritime connectivity for decarbonization, and how connectivity creates safer ships. Both Inmarsat and Starlink contribute significantly to maritime operations by offering:

- Enhanced Real‑Time Communication: Facilitates immediate data exchange between vessels and shore‑based operations.

- Optimized Fleet Management: Supports real‑time monitoring and remote diagnostics, enhancing operational efficiency.

- Improved Navigation and Route Optimization: Provides up‑to‑date weather information and supports dynamic route adjustments, thereby improving safety and fuel efficiency.

- Support for Advanced Technologies: Enables IoT integration, edge computing, and lays the groundwork for the future deployment of autonomous vessels.

- Enhanced Safety and Emergency Response: Maintains reliable communication channels during emergencies and supports real‑time video inspections.

Here’s our comparison of these two maritime connectivity solutions, based on their publications and industry reports:

Geographic Coverage

Inmarsat

- Satellite Configuration:

Inmarsat operates a network of geostationary satellites positioned approximately 35,786 kilometers above the equator. This configuration ensures near‑global coverage—excluding polar regions—with consistent connectivity over defined areas. - Service Regions:

Inmarsat’s coverage is organized into three primary service regions:- I‑4 Americas: Covers the American continents.

- I‑4 EMEA: Encompasses Europe, the Middle East, and Africa.

- I‑4 Asia‑Pacific: Serves the Asia‑Pacific region.

- Limitations:

- Vessels operating at extreme northern or southern latitudes may experience reduced signal quality due to lower satellite elevation angles.

Starlink

- Satellite Configuration:

Developed by SpaceX, Starlink employs a constellation of low Earth orbit (LEO) satellites orbiting at altitudes between 340 and 1,200 kilometers. The lower altitude allows for high‑speed, low‑latency connectivity. - Coverage and Expansion:

- As of early 2023, Starlink announced global maritime coverage, including international waters.

- Coverage is rapidly expanding, though certain remote oceanic regions, as well as some polar areas, remain under development.

- Regulatory constraints exist in certain regions (e.g., China, UAE, South Africa, Taiwan, and Saudi Arabia), where Starlink services are either restricted or require users to disable service.

Impact of Satellite Altitude

The altitude at which satellites operate significantly influences performance metrics:

- Inmarsat’s Geostationary Satellites:

- Advantages: Provide extensive coverage with a relatively small number of satellites.

- Drawbacks: Incur higher latency (approximately 250 milliseconds or more) due to the long distance from Earth.

- Starlink’s LEO Satellites:

- Advantages: Offer lower latency—averaging between 25 to 60 milliseconds on land and around 100 milliseconds in remote maritime settings—and higher bandwidth.

- Drawbacks: Require a larger constellation to maintain comprehensive global coverage.

The trade‑offs between latency, coverage, and satellite constellation size are central to selecting the appropriate solution based on operational needs.

Market Share Considerations

- Inmarsat:

- Has established a dominant market presence in maritime communications, especially among large commercial fleets that value proven performance and comprehensive support services. based on Business Wire Inmarsat has a a market share of 39.49% in the merchant shipping sector.

- Starlink:

- Despite being a relative newcomer, Starlink has rapidly gained market acceptance, achieving approximately 25% market penetration among satellite‑connected vessels within less than two years. Its swift adoption is largely attributed to its high‑speed, low‑latency internet service.

Comparative Analysis

Below is a detailed comparative analysis of Inmarsat and Starlink based on key performance parameters:

Latency

- Inmarsat:

- Utilizes geostationary satellites, resulting in higher latency (typically around 250 milliseconds or more).

- Starlink:

- Leverages LEO satellites with lower latency, averaging between 25 to 60 milliseconds on land and approximately 100 milliseconds in remote maritime locations.

Speed

- Inmarsat:

- Provides mobile broadband speeds up to 50 Mbps.

- Starlink:

- Delivers download speeds exceeding 200 Mbps, which, combined with low latency, supports high‑bandwidth applications such as HD video streaming and real‑time data analytics.

Coverage

- Inmarsat:

- Offers near‑global coverage over most oceans, utilizing geostationary satellites positioned around 35,000 kilometers above the equator.

- Starlink:

- Provides an expanding network of LEO satellites that offer extensive coverage over international waters. However, users should note the geographic restrictions in certain regions.

Technical Support and Operational Functionalities

- Inmarsat:

- Possesses a long‑standing presence in the maritime industry with established technical support and a service infrastructure tailored to maritime operations.

- Offers Global Maritime Distress and Safety System (GMDSS) compliant services.

- Supports critical operational functionalities, including real‑time communication, fleet management, navigation updates, and crew welfare services.

- [Sources: interactive.satellitetoday.com, gtmaritime.com]

- Starlink:

- As a newer entrant, Starlink is still expanding its support services.

- Not currently GMDSS‑compatible, which may be a consideration for certain commercial vessels.

- Provides similar core functionalities with enhanced performance in terms of speed and latency.

- [Sources: cruisersforum.com, starlink.com]

Installation and Implementation

- Inmarsat:

- The installation process for Inmarsat systems typically involves sizable antenna equipment due to the higher altitude of geostationary satellites.

- Installation is complex and may require professional assistance, with setups taking several days in port.

- The size and weight of the equipment can pose challenges, particularly for smaller vessels.

- Starlink:

- Offers a more streamlined installation process.

- The hardware is relatively compact and user‑friendly, facilitating quicker setup without the need for specialized labor.

- This simplicity makes Starlink an appealing option for a wide range of maritime operators.

- [Source: interactive.satellitetoday.com]

Cost Analysis

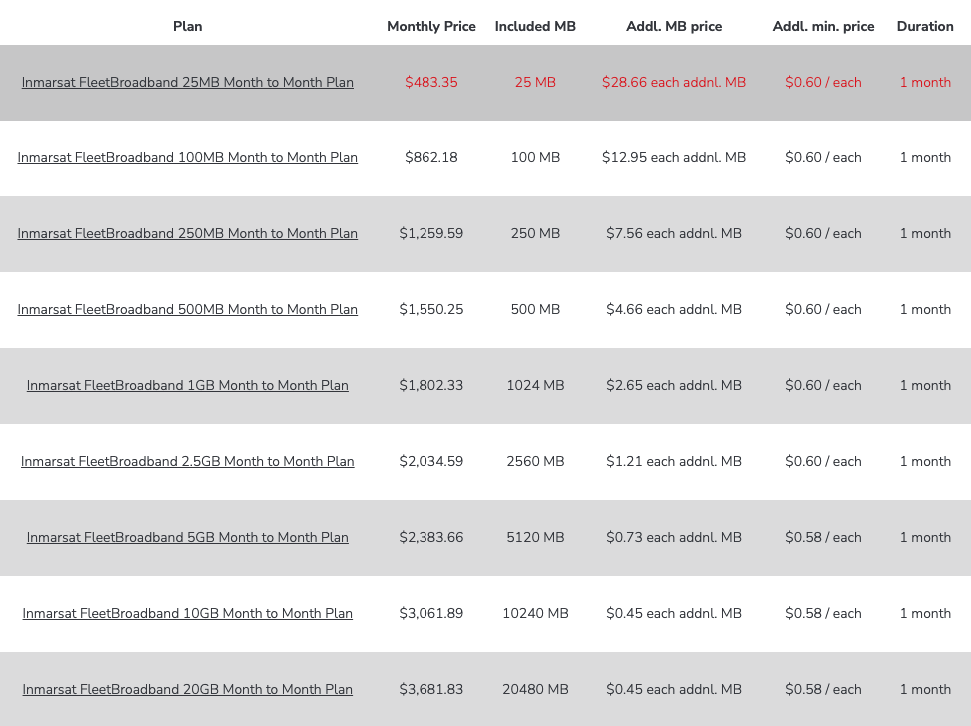

Inmarsat Pricing

Inmarsat provides various FleetBroadband service plans tailored to different data consumption levels. Key offerings include:

Note: Inmarsat also offers 12‑month and 24‑month contract plans with varied pricing and data allowances.

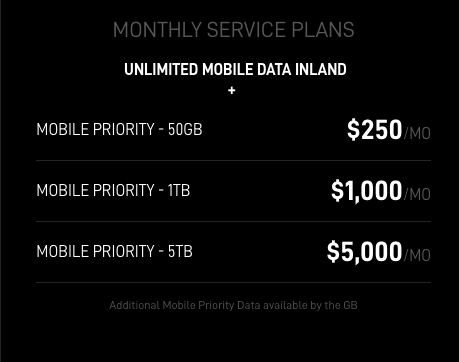

Starlink Pricing

Starlink’s maritime service plans are designed to deliver high‑speed internet with differing data priorities:

Additional Costs:

- Starlink hardware for maritime service is approximately $2,625.

Marlink Connectivity Solutions

Marlink is recognized as a leader in hybrid network solutions and digital services for the maritime industry, accounting for 25% of the merchant tanker market (2022). Their offerings include:

- Comprehensive Hybrid Network Solutions:

- Marlink integrates satellite (VSAT), terrestrial (4G/5G), and LEO services to provide seamless, resilient global coverage.

- This approach ensures uninterrupted connectivity, even in remote regions, by dynamically switching between available networks.

- Digital Services and Cybersecurity:

- Beyond connectivity, Marlink delivers tailored digital solutions such as cloud access, network management, and robust cybersecurity services.

- These solutions facilitate the digitization of maritime operations and help secure critical data.

- Strategic Partnerships:

- Marlink collaborates with leading satellite network operators.

- Their portfolio includes the integration of SpaceX’s Starlink service and Inmarsat’s Fleet Xpress.

- This strategic alliance provides customers with the benefits of high‑speed, low‑latency broadband alongside the reliability of established geostationary networks.

In summary, commercial maritime fleet operators must consider a range of factors when selecting a connectivity solution. Inmarsat and Starlink each offer distinct advantages:

- Inmarsat:

- Provides reliable, near‑global coverage via geostationary satellites.

- Excels in markets that require proven performance and comprehensive technical support.

- Offers established GMDSS‑compliant services, though at higher latency and operational costs.

- Starlink:

- Delivers high‑speed, low‑latency connectivity through its LEO satellite constellation.

- Is rapidly gaining market share with its competitive performance metrics.

- Presents an appealing solution for operations that demand high data throughput, albeit with current limitations in GMDSS compatibility and regional restrictions.

This comparative analysis is intended to support informed decision‑making for fleet owners and CTOs by highlighting the technical and operational trade‑offs inherent in each connectivity option. With connectivity playing an increasingly pivotal role in maritime operations, aligning technology solutions with operational requirements is essential for achieving long‑term success and operational excellence.

Note: The information presented in this analysis is based on available data as of February 2025. For the most current details, please consult the official resources of Inmarsat, Starlink, and Marlink.